Fairway Independent Mortgage Corporation's Fix for a Future of eClose

Today’s borrowers want to do everything online and they want answers fast. They are also putting their trust in their lender, loan officer and settlement agents when making one of the biggest decisions of their lives, so how can lending partners honor that trust and keep up with this digital demand? The lending industry’s answer is through learning how digital solutions can meet borrowers’ needs—and their demands.

For one lender, Fairway Independent Mortgage Corporation (Fairway), the best way to earn that trust is by continually exceeding their clients’ expectations. One of the biggest ways they’ve done that is with eClosings.

Fairway’s journey to implementing eClosings wasn’t easy, but they believe the results were worth every bit of the effort. Those results have seen Fairway emerge as an industry leader in digital mortgage closings. Not only did they meet their goal of completing 50% or more of their eligible transactions digitally, but they are now leading by example – sharing their story so lenders like you can benefit from eClosings too.

The Value of eClosings

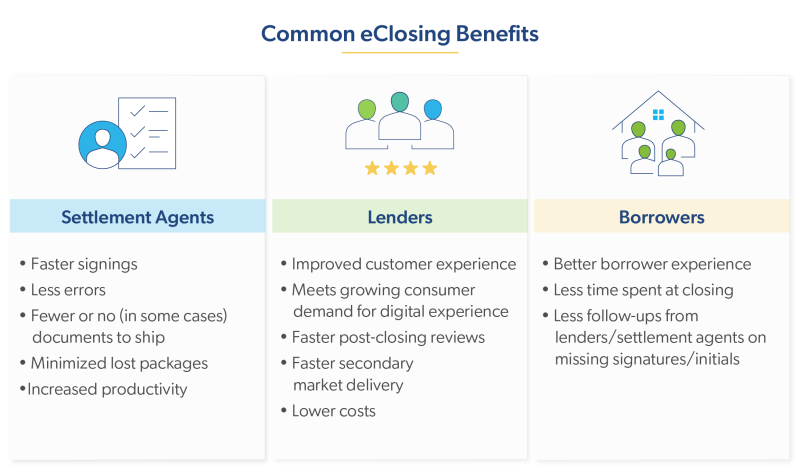

To get their organization — and their clients — on board, Fairway needed to show the value eClosings can bring to their business. Lenders that leverage eClosings can see significant benefits for all parties involved in the mortgage process:

Advancing Through Adoption Barriers

Resistance to change is inevitable when introducing new solutions. Fairway focused on three areas in their network that would benefit from eClosings: settlement agents, their internal team members and their partners. They approached each group differently to ease possible concerns and encourage adoption:

The Myth of Bifurcation

Besides the various adoption barriers, the myth of bifurcation is another common hesitation to implementing eClosings. Fairway has addressed this myth with their network and offers a bifurcated eClosing process that works.

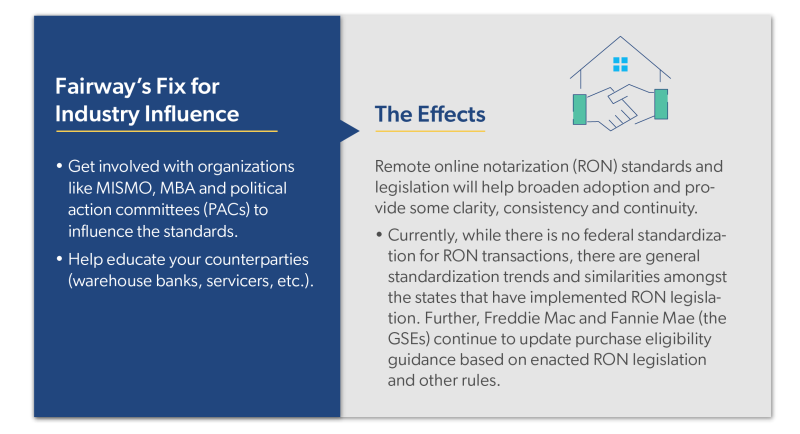

Influencing Different Industry Standards

Fairway recognizes that overall industry standards heavily influence the future of digital solutions and eClosings. Without this bigger change, getting over adoption barriers and debunking myths won’t be as meaningful. They’ve taken steps to help change industry standards at the source, leveraging their influence and reputation to make eClosing adoption consistent across the board.

Fairway is Leading the Way

The trust Fairway has built with partners throughout the industry has propelled them into being a leader of digital closing solutions. Their strong emphasis on trust has helped others adopt eClosings with the assurance that this change has value for everyone involved.

Fairway is leading by example, showing that eClosings have value. They won’t stop here — they are continuously looking to influence the future of eClosings, making it easier for everyone in the industry to get behind this digital closing movement.

Want to Start Your Journey?

For more information on eClosings, visit our eMortgage web page. Start your eClosing implementation today by reaching out to the Freddie Mac eMortgage team at [email protected].